Byju’s rejects investors’ vote to sack CEO as invalid

Top shareholders in troubled Indian educational technology firm Byju’s, including investment giant Prosus, voted on Friday to sack its billionaire founder, a decision the once high-flying company refused to recognise.

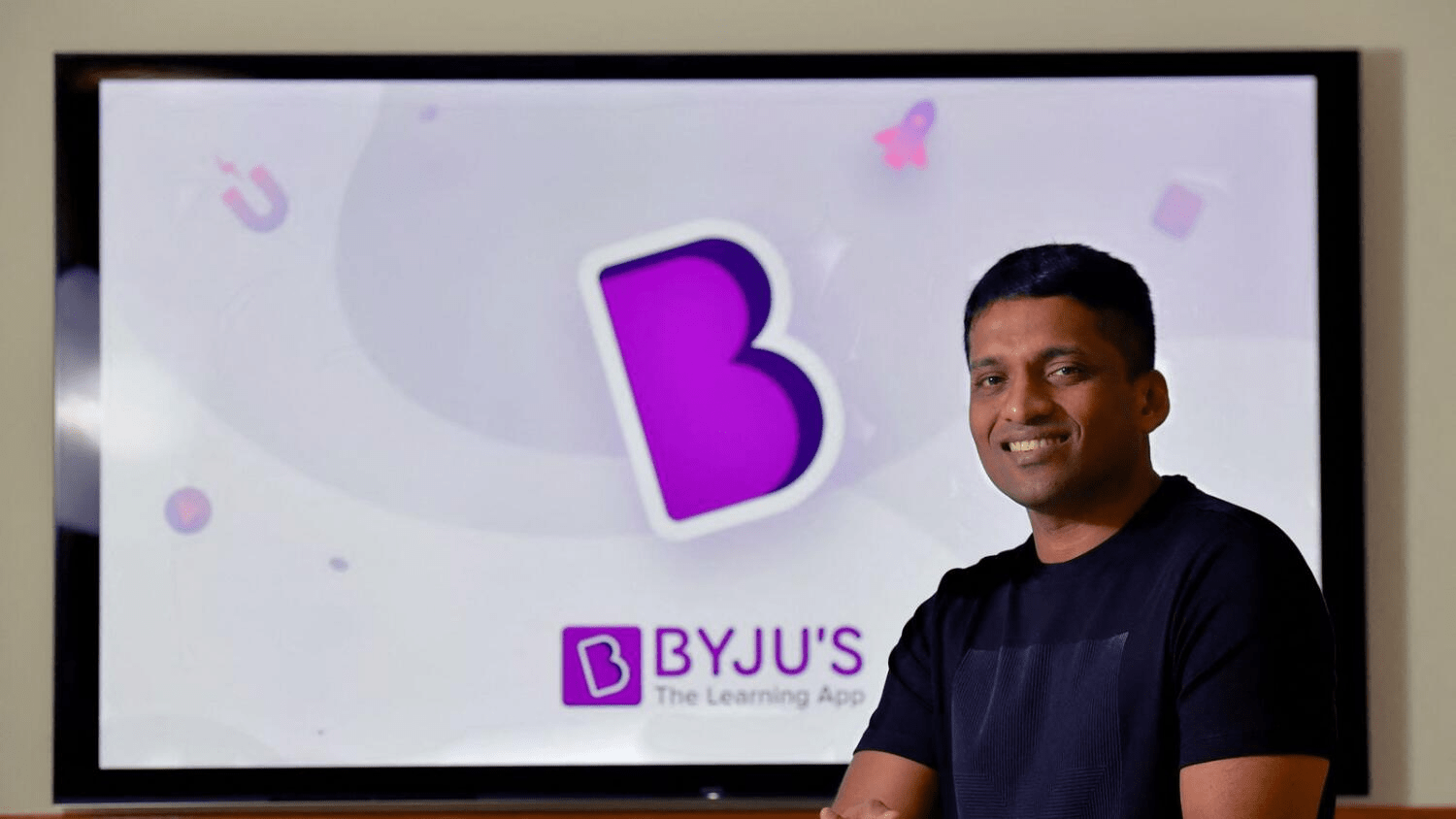

Byju’s, which is controlled by CEO Byju Raveendran, was formerly one of India’s most valuable start-ups as demand for its online learning products boomed during the Covid pandemic.

Once valued at more than $20 billion, Byju’s has seen its valuation crash by an estimated 90 per cent over the past year.

Risky acquisition bets and waning demand once locked-down students returned to classrooms left it overstretched and with hard-to-justify valuations.

Shareholders unanimously voted for several resolutions, including one demanding a reconstitution of the board of directors, at an extraordinary general meeting held online, Prosus said in a statement.

The move was rejected by Byju’s, which said the resolutions were passed at a meeting attended only by a “small cohort of select shareholders”.

“Byju’s firmly declares that the resolutions passed during the recently concluded extraordinary general meeting… are invalid and ineffective,” the company said in a statement.

“The passing of the unenforceable resolutions challenges the rule of law at worst.”

Raveendran has lost the support of key investors after a series of crises, including the resignation of auditor Deloitte over corporate governance issues and a legal fight with US lenders over a $1.2 billion loan.

Several major shareholders — including Prosus and the Chan Zuckerberg Initiative, a philanthropic venture set up by Facebook boss Mark Zuckerberg and his wife Priscilla Chan — demanded an extraordinary general meeting this month to press for Raveendran’s ouster.

Indian media reports said the combined ownership of shareholders who voted on the resolutions exceeded 60 per cent.

Prosus said it was confident in the “validity” of Friday’s meeting and its “decisive outcome”.

It was a symbolic victory for investors, at least for the time being.

An Indian court ruled this week that no decisions taken at the meeting could be implemented until after a future hearing in another case brought by Byju’s against investors.