Hong Kong, Chinese investors set eyes on Saudi market

- A delegation of business leaders is set to explore diverse sectors in the Kingdom

RIYADH: Hong Kong and Chinese companies are gearing up for substantial investments in the Saudi market, marking a significant step toward strengthening economic ties, a top official said.

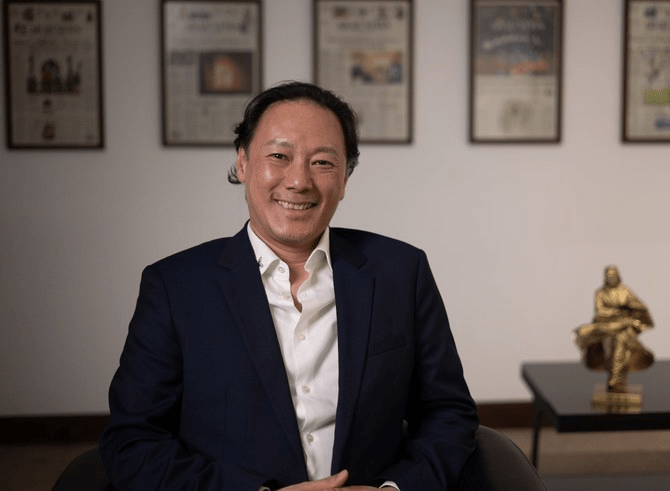

A delegation of 30 business leaders from Hong Kong and mainland China is set to explore diverse sectors in the Kingdom, propelled by the ambitious Vision 2030 outlined by Saudi leadership, King Leung, global head of financial services and fintech at Invest Hong Kong, said in an interview with Arab News.

Explaining the reason for his visit to Riyadh, Leung said: “I’m bringing a delegation of 30-plus executives across different disciplines to explore ways to do business in Saudi Arabia. This is not just about attracting inbound (investment), but also helping mainland Chinese companies use Hong Kong as a base to springboard to key markets like Saudi Arabia.”

Outlining the potential for co-investment between the two nations, he said: “Definitely, it’s going to be a huge number,” a sentiment that echoes the palpable excitement among Hong Kong investors who are eager to tap into the vast opportunities offered by the Saudi market.

The convergence of interests between Hong Kong and Saudi Arabia is underpinned by a notable synergy observed between businesses in both regions, the executive said, with an eye on forging strategic partnerships.

Hong Kong delegates, including private sector leaders and venture capitalists, are eager to explore avenues for collaboration that align with the objectives of Vision 2030.

“All these things that we are now finding out allow business leaders to see that some businesses from Hong Kong actually have very, very good synergy with Vision 2030 in your country.”

“It’s hard to quantify the exact number, but definitely, it’s going to be (a) huge number. I have to say these investments cut across different sectors, where you can imagine the market size is enormous,” he said, emphasizing the allure of megaprojects such as NEOM and the King Salman Park, which are set to transform the Saudi investment landscape.

These projects not only serve as magnets for investment but also catalyze growth in ancillary sectors such as financial services and consumer products, the head of financial services emphasized.

“These are megaprojects. So, all these things are going to really attract a lot of business activities, of course, initially in construction. But once you have all this construction coming in, then you need the other peripheral sectors to service them, like financial services, consumer products, and payments. So, all these things present a lot of opportunities that really get our delegates and investors from Hong Kong and China very excited,” he further explained.

Another testament to the nation’s favorable investment ecosystem is its “impressive GDP growth and low debt ratio,” factors that instill confidence among investors.

Among the sectors garnering attention are green energy and advanced manufacturing, the delegate said, affirming that Saudi Arabia is “paving the way for the future” of clean energy.

Hong Kong-based companies, armed with cutting-edge technologies, are eyeing opportunities to contribute to Saudi Arabia’s sustainable development goals.

“I understand that your country is also paving the way for the future, including adopting green energy now. So, one green energy company that I have been talking to in mainland China, they have been in the green hydrogen space for some time, and they are evaluating to put a green hydrogen factory in Saudi Arabia.”

Thus, projects such as the green hydrogen factory, poised to harness solar power for hydrogen production, exemplify this collaborative spirit.

“Now, of course, the reason why they’ve done that, part of it, is because the way they generate hydrogen is to use solar power. So they need to go to a place where this is something in abundance. Now, at the same time, you also have some highly visionary, highly capable investment vehicles from the PIF and other funds,” he noted.

Furthermore, the burgeoning fintech ecosystem in Saudi Arabia presents fertile ground for collaboration between Hong Kong and the Kingdom.

Fintech companies from Hong Kong are eager to leverage their expertise to enhance banking services and drive digital transformation initiatives in the Kingdom, the executive noted, adding, “In our delegation, we have roughly, I’ll say between 10 to a dozen or so fintech companies that are very keen to see if they can bring the business and set up in Saudi Arabia so that they’re able to service the banks here.”

On the opposite end, recognizing the potential for synergy, banks from Saudi Arabia are contemplating establishing a presence in Hong Kong to bolster their trade and financial services, he said.

This strategic move aims to capitalize on Hong Kong’s strategic position as a gateway to the Chinese market, thereby facilitating closer economic ties between Saudi Arabia and China.

“Of course, we would love to see some Saudi companies set up in Hong Kong. In fact, two of the significant meetings we had were with banks, and now these banks are interested in setting up a presence in Hong Kong,” the official said.

“This is because of the close trading relationships, and they would like to have a presence in Hong Kong to serve, for example, Chinese customers. This way, they can facilitate services like trade finance and various other services handled by the headquarters in Riyadh,” he added.

This comes after a pivotal moment in strengthening the economic ties between Hong Kong and Saudi Arabia, marked by the signing of a memorandum of understanding between Invest Hong Kong and the Ministry of Investment of Saudi Arabia last year.

As a result of this agreement, delegates from Hong Kong have been afforded unique insights into Saudi Arabia’s macroeconomic landscape, grand vision, and burgeoning investment opportunities, further fueling their enthusiasm for collaboration and investment in the Kingdom.

“Last year, our leader at Invest Hong Kong signed an MoU with MISA. That MoU brought us even closer together. They have been very kind to bring in leaders from different aspects to educate us about your country, from macroeconomic data to the grand vision from leaders in both the public and private sectors,” he said.

Leung said they also shared insights into projects that have already gained significant traction. “All in all, our delegation was super impressed by the progress made by the country,” he concluded.