UAE’s new payment card Jaywan: Here is all you need to know

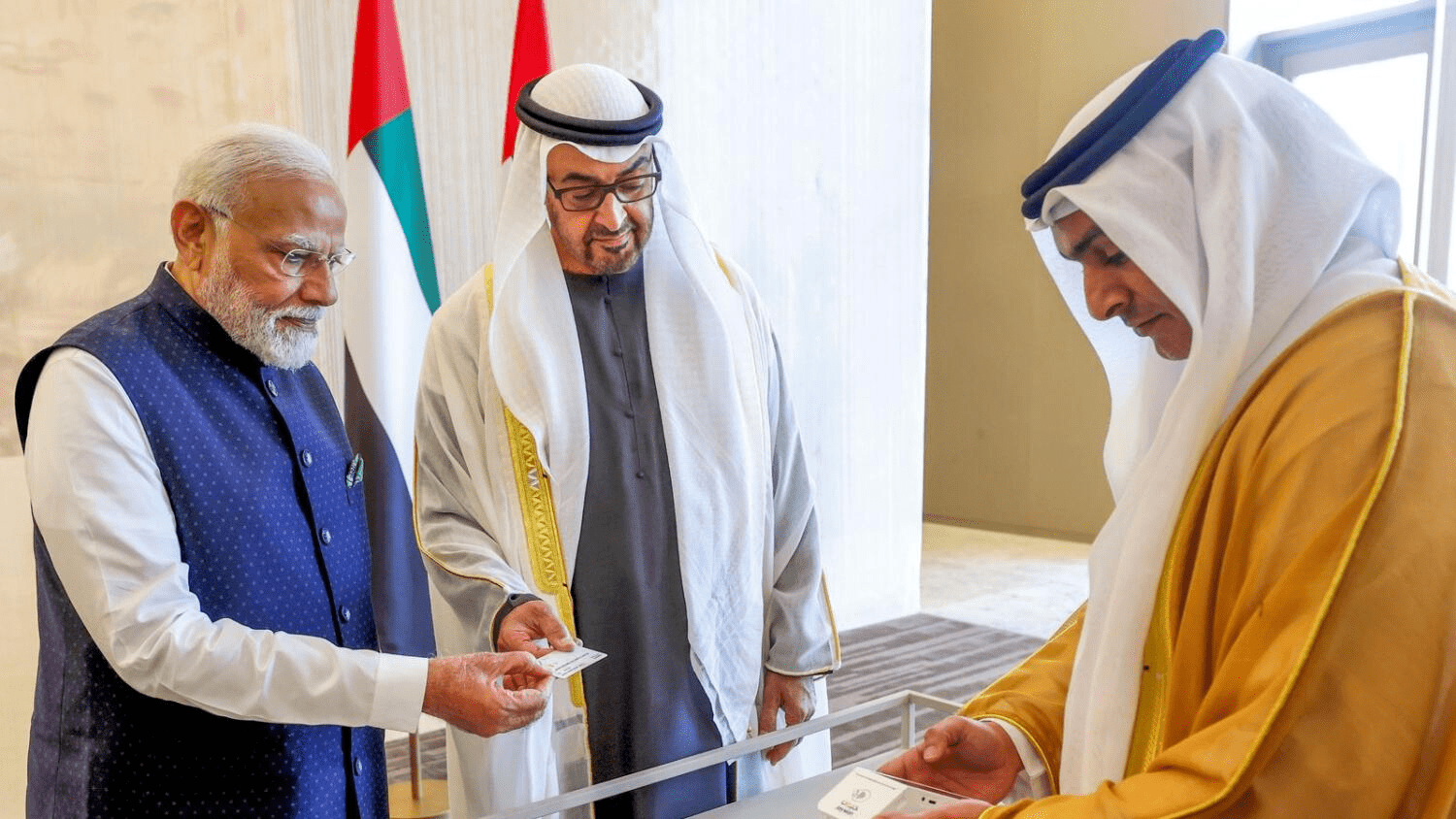

A new payment card was launched during Indian Prime Minister Narendra Modi’s visit to the UAE on Tuesday. Jaywan is built on India’s digital RuPay credit and debit card stack for the UAE market.

The two countries also agreed to link their instant payment platforms – India’s UPI and UAE’s AANI – as this will promote a wider acceptance of credit and debit RuPay cards in the country.

“We are stepping into a new FinTech era with the launch of my UPI RuPay card and your Jaywan card,” Modi said after the launch in Abu Dhabi on Tuesday.

Khaleej Times reached out to financial industry experts to find out more details about whether UAE residents, specifically Indians, can apply for Jaywan and how. Below are the answers shared by Vijay Valecha, chief investment officer of Century Financial, and Yusuf Mansawala, chief market analyst at CPT Markets, Dubai.

What is the difference between Jaywan and RuPay?

Vijay: RuPay, introduced by the National Payments Corporation of India, serves as India’s digital credit and debit card infrastructure. It can be likened to the Indian equivalent of Visa or Mastercard, designed to realise the vision of the Reserve Bank of India (RBI) to establish a domestic, open, and multilateral payment system. On the flip side, Jaywan emerges as the latest domestic payment card in the UAE, crafted upon the foundation of India’s RuPay. Jaywan adopts interfaces akin to those of RuPay. Jaywan’s debut follows bilateral agreements between the two nations, including the integration of swift payment systems.

Yusuf: Transactions conducted with Jaywan are denominated in UAE dirhams, thereby eliminating any foreign exchange fees and currency conversion obstacles commonly encountered when using RuPay for international transactions, as RuPay operates in Indian rupees.

How will Jaywan benefit UAE residents, specifically Indian expats?

Vijay: As India’s Minister of Commerce and Industry Piyush Goyal said, the linked domestic card system will mitigate currency risks and enhance travel between the two nations. RuPay cards from India are usable in the UAE, and Jaywan cards from the UAE are functional in India. This eliminates the necessity for individuals travelling between India and the UAE to carry large amounts of cash or numerous plastic cards, as having a Jaywan card is sufficient. Furthermore, Jaywan card users can conduct transactions in local currencies without the inconvenience of currency conversion, providing significant advantages for frequent travellers.

The Jaywan card provides comparable functionalities to other local cards in the UAE, like the Emirates NBD Classic Card and the Dubai Islamic Bank Classic Card. Notably, it distinguishes itself by its integration with the RuPay network, potentially providing broader acceptance in the future, especially for cross-border transactions involving India.

Can anyone apply for a Jaywan card in the UAE?

Vijay: Yes. All UAE residents with a valid Emirates ID can apply for it.

What is the purpose of launching Jaywan in the UAE?

Vijay: There are roughly 3.89 million Indians in the UAE, accounting for about 37.96 per cent of the UAE population. The introduction of such a unified payment system between both nations is to strengthen the existing relations between both countries. Furthermore, it paves the way for increased investment cooperation in the digital infrastructure sector. The card’s introduction is a step toward boosting the digital economy and fostering economic ties between the two nations.

Yusuf: Its primary goal is to enhance trade relations between India and the UAE by promoting digital transactions and facilitating seamless business exchanges. Moreover, it strives to promote financial inclusivity within the UAE, specifically for Indian residents, by offering a convenient and affordable payment solution designed to meet their requirements. Ultimately, it represents a significant stride towards integrating the payment systems of both nations, thereby advancing financial cooperation and economic partnership.

Can Indian tourists in UAE use Jaywan and RuPay?

Vijay: Yes. Indian tourists in the UAE can use Jaywan and Rupay for transactions made in the UAE.

What is the advantage of having a Jaywan card?

Vijay: Upon its initial launch, RuPay imposed transaction processing fees that were approximately 23 per cent lower than those of Visa and Mastercard. The National Payments Corporation of India (NPCI) applied a flat fee per transaction, collecting 60 paise from the acquiring bank and 30 paise from the card-issuing bank. For instance, in a transaction using a RuPay card at a PoS terminal from another bank, the customer’s bank (issuer) paid 30 paise to the NPCI, and the POS terminal’s operating bank (acquirer) paid 60 paise. With the promotion and anticipated popularity of the Jaywan card in the coming years, similar discounts to RuPay can be anticipated for Jaywan. This strategy aims to incentivise residents to opt for Jaywan by highlighting its cross-country advantages.

Yusuf: By minimising cross-border transaction costs and potentially reducing domestic fees, Jaywan enables users to save a substantial amount of money in the long run.

Moreover, the simplified transactions within the UAE and the possibility of international acceptance through RuPay network partnerships enhance the convenience factor.

Lastly, Jaywan utilizes the robust security infrastructure of the RuPay network, providing users with peace of mind and ensuring their transactions are secure.

Which banks are offering RuPay and Jaywan?

Vijay: RuPay’s parent entity, the National Payments Corporation of India (NPCI), is backed by 10 major banks. These include six public-sector banks: State Bank of India, Bank of Baroda, Punjab National Bank, Canara Bank, Union Bank of India, and Bank of India; two private-sector banks: ICICI Bank and HDFC Bank; and two foreign banks: Citibank and HSBC. Indian banks are granted the authority to provide RuPay debit cards to their customers for utilization at ATMs, Point of Sale (PoS) terminals, and online commerce platforms. With regards to the UAE, currently, 4 banks are offering the Jaywan card, they are First Abu Dhabi Bank (FAB), Abu Dhabi Commercial Bank (ADCB), Mashreq Bank, and Commercial Bank of Dubai (CBD).